Don’t expect Utah real estate to do anything crazy this year.

That’s what agents and brokers were told at the Salt Lake Board of Realtors’ annual housing forecast event in Salt Lake City.

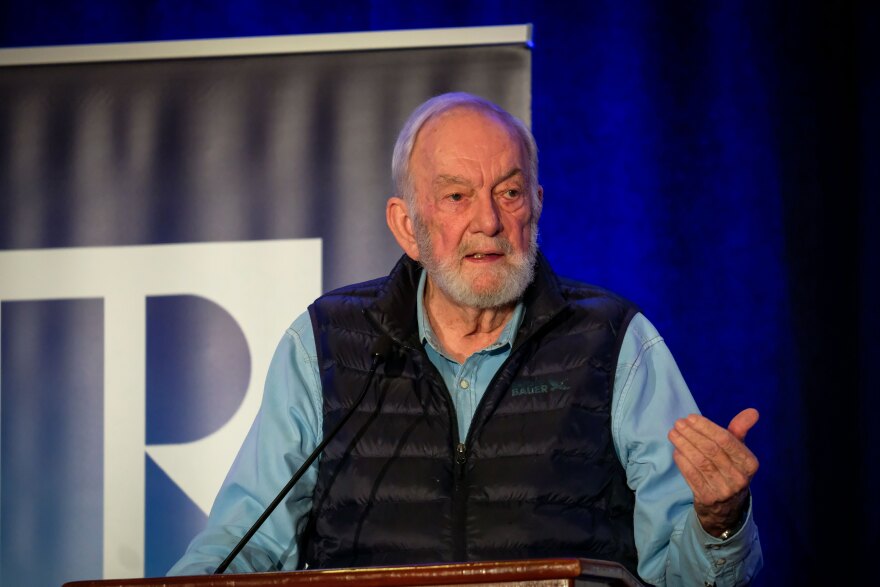

The business of buying and selling houses is expected to be more or less stagnant in 2026, said Kem C. Gardner Policy Institute Senior Fellow James Wood.

“I don't see many indicators out there that can say, well, we're going to, all of a sudden, see a surge in buying or a surge in prices,” he said. “I think we’re paying the piper for what happened during COVID with extremely low interest rates and the sales surge that we had during those years. So it's a market that's really holding its own, but really running in place.”

Soaring home prices and low interest rates made for a hot market during the whirlwind years of the pandemic. After interest rates doubled in 2022, the market cooled off.

From 2024 to 2025, Utah saw the median sale price for single-family, townhomes, condominiums and twin homes rise by 1.9% to $550,000. The number of residential sales fell by 2.4% to 11,797. Wood said to expect more of the same in 2026.

“We're in the fourth year of this [pandemic] recovery, and it's going to take probably another year to really get to the end of this, I think, and we'll get to more normal rates of sales and more normal rates of price increases,” he said.

According to Wood, the tepid forecast is largely because of factors like looming economic uncertainty and a gradual slowdown in Utah’s growth, which has been at record levels in recent years.

Interest rates, however, present a double-edged sword.

On one hand, Wood said 61% of Utah mortgage holders currently have a rate under 4%, which makes the prospect of selling and moving less appealing when the Federal Reserve puts the national average for interest rates on a 30-year mortgage at 6.15% as of December 2025.

On the other hand, those same rates are slowly beginning to drop. The current rate is down from a high of 7.8% percent in 2023.

While that’s not the best news for an owner looking to maximize their investment, it does provide an opening for buyers who have felt shut out of the market.

The push and pull of interest rates is something National Association of Realtors Deputy Chief Economist & Vice President of Research Jessica Lautz is keeping a close eye on.

“When we think about the last three years in real estate, it's really been sluggish,” she said. “Interest rates went up. A lot of people made a move during 2020-2021 when interest rates were incredibly low. As they jumped, we saw just gridlock.”

She also has a slightly rosier outlook on 2026 in Utah, where Salt Lake City was named a top-10 housing hot spot for 2026.

“That young population was really flagged as one of those reasons,” she said. “Job growth is one of those reasons, too, and also migration flow. We're still seeing people move here. And as you see people move here, they're moving here with money. They're moving here with the ability to purchase homes.”

Those factors, she said, could see Salt Lake City and Utah outpace much of the rest of the country in housing sales this year. When it comes to interest rates inching their way back down, she sees that as good news for builders.

“As they see improvement there, they are going to come back into the market,” she said.

That increased supply could open up more opportunities for first-time buyers and those looking to move, something state leaders have been hoping to accelerate.

Despite the sluggish market in recent years, according to Wood’s analysis, housing prices could actually reach a level that they would have naturally gotten to in the near future if there were no pandemic inflating prices to begin with.

“I think where we are now, it's going to be another year or 18 months before we see much movement in housing prices,” he said. “And again, that has implications for sales, but also important implications for those who are trying to get into the housing market.”

Despite the forecasted ups and downs, things like higher down payments, student debt and child care costs still make buying a first home in 2026 a tough sell.